OCBC FRANKpreneurship 2025

“Financial Solutions for Fluid Lives: Catering to Multi-Stage Careers and Non-Linear Paths”

With people living longer and experiencing multiple career shifts, gig work, and periods of re-education, how can a bank redesign its products and services to support highly fluid and non-linear life paths?

Solution

OCBC SideBiz

Timeline

May - August 2025

Background

OCBC FRANKpreneurship is the bank’s flagship summer internship programme. As part of the 2025 cohort of interns, we were split into teams to work on the following problem statement:

Financial Solutions for Fluid Lives: Catering to Multi-Stage Careers and Non-Linear Paths

With people living longer and experiencing multiple career shifts, gig work, and periods of re-education, how can a bank redesign its products and services to support highly fluid and non-linear life paths?

I was part of a team of 5 interns who worked on this case study from scratch, from problem scoping and user research, to developing the final solution. We received guidance from mentors from the bank’s Group Customer Experience division, who introduced us to the fundamentals of user experience frameworks and methods, which shaped our approach towards tackling the problem. The project culminated in two milestone presentations delivered to a panel of senior OCBC leaders, including Group Heads and Business Heads of various divisions such as Group Operations & Technology, Global Consumer Financial Services, and Global Commercial Banking, amongst others.

Alongside this project, us interns also carried out our day-to-day responsibilities within our various departments, balancing both internship deliverables and this case study project. This dual commitment gave me the opportunity to gain hands-on exposure to real banking operations while simultaneously tackling the challenge of innovating for the future of banking.

My Role

I was the design lead in this project and the sole designer, owning the end-to-end design process and delivering the working prototype across all phases of the project. Beyond the execution of the design, I also led user research, customer interviews, and usability / concept testing, while collaborating closely with my team on problem framing, journey mapping, market research, and competitor analysis.

Key contributions:

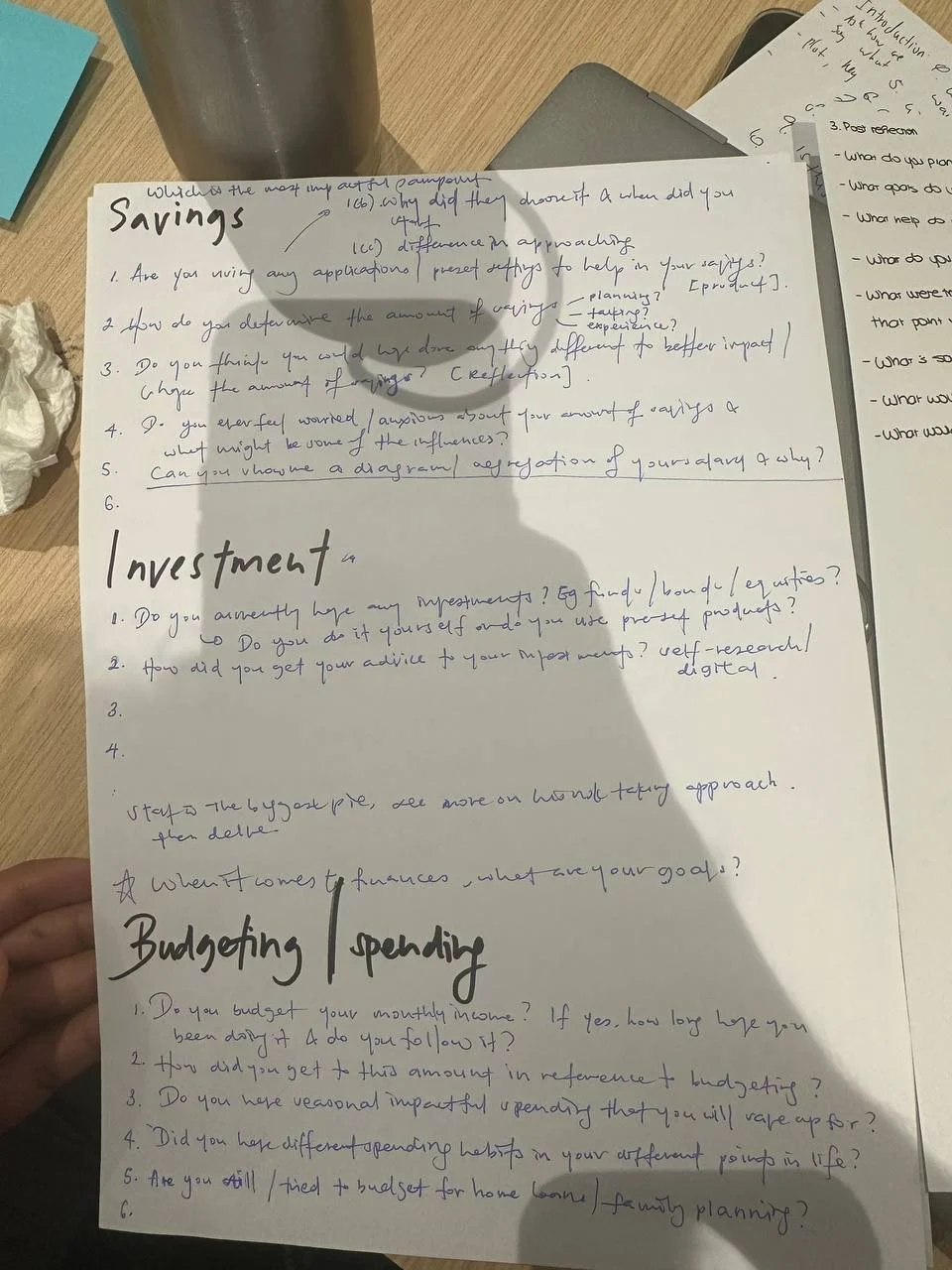

Conducted in-depth user research → interviewed our target audience (eg. freelancers, gig workers, side business owners) to uncover pain points and challenges

Synthesised insights into design artifacts → used tools such as journey maps, user personas, empathy maps, and affinity diagrams to guide decision making

Drove the design process → iteratively developed low to high-fidelity prototypes over the 3 months

Led usability and concept testing → validated solution ideas and refined the product experience based on user feedback

Performed market and competitor analysis → identified opportunity gaps and informed product differentiation

Facilitated structured ideation sessions → applied design thinking methods to co-create and expand on potential solution concepts with the team

Solution

My team and I developed OCBC SideBiz, a feature-rich widget embedded directly within the OCBC mobile banking app, designed to help side business owners seamlessly track and organise their finances while gaining clear, actionable insights to their business performance. We aim to empower SideBiz users with the ability to make better decisions about their business, through improved clarity and visibility.

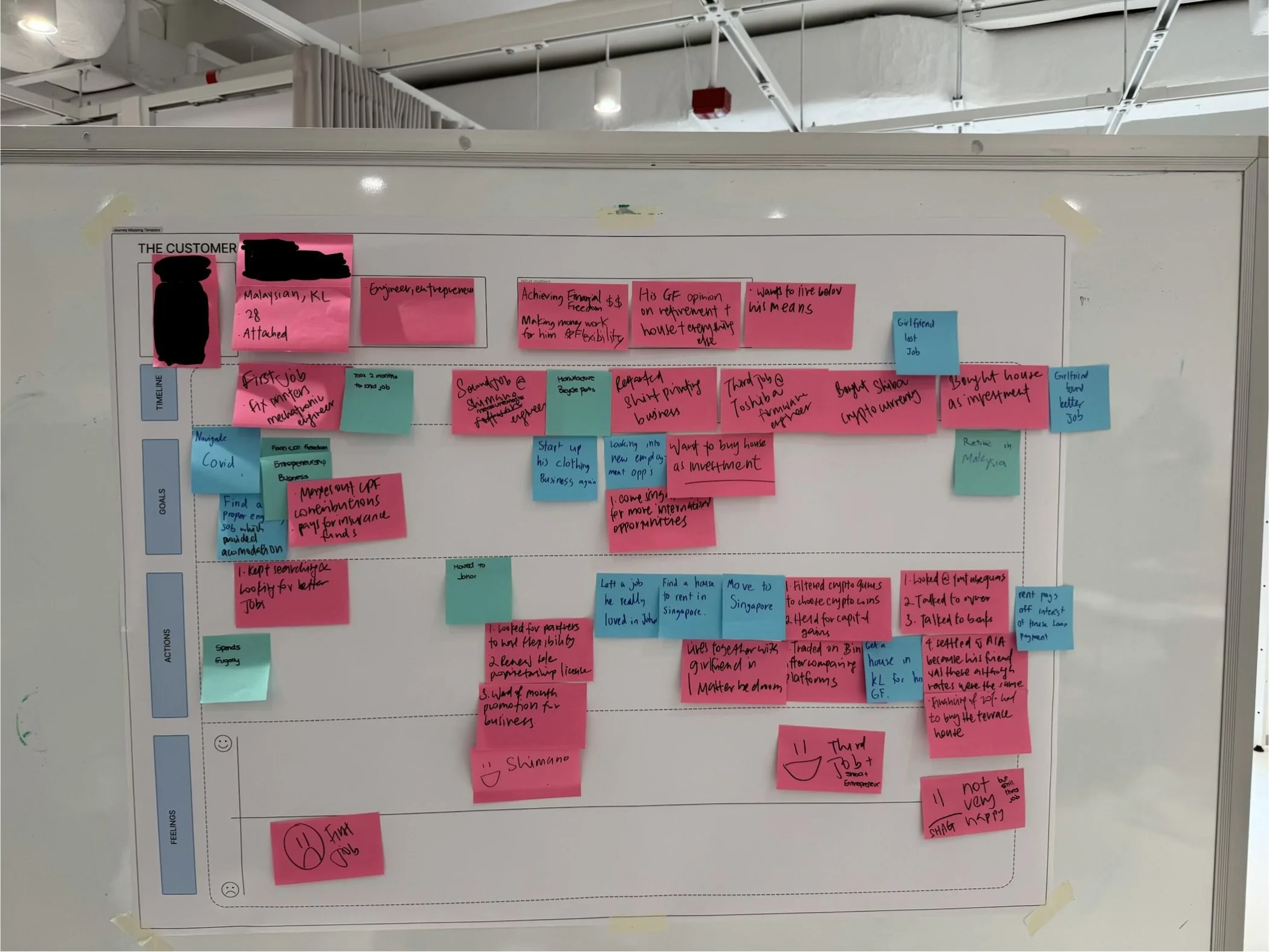

Post-interview journey mapping of bank customer ‘C’

This initial interview helped us surface potential pain points and gaps, which we then sought to validate through broader research. As our research progressed, we noticed a recurring trend of many people being interested in starting side businesses or taking on gig work, which was a form of fluidity and non-linearity in life path. We honed in on this as a key area of focus and iteratively refined our interview and survey questions to explore it further.

Over the next few weeks, we conducted:

10+ participant interviews → a mix of Zoom sessions for remote participants and face-to-face interviews for those available in person

Supplementary online surveys → reaching participants who could not commit to an interview but still provided valuable input

Secondary research → analysing manpower statistics and labour force data from both local government sources and overseas reports to understand trends in side gigs and self-employment

Together, these methods gave us both real-life qualitative stories and supporting quantitative data, allowing us to paint a clear picture of the growing prevalence of side businesses and gig work, and the financial/non-financial challenges that come with them.

Online Zoom interview with bank customer ‘M’

Online Google form survey

Analysis of micro-SME landscape in Singapore, in order to understand potential growth of side businesses

Key Findings from User Research

From our research, we identified several strongly recurring themes:

Rise of side income methods → Many participants sought additional ways of earning beyond their full-time jobs, such as running small side businesses or taking on gig work.

Lack of formal business practices → People who chose to start side businesses of different kinds often treated their ventures as ad-hoc income streams, avoiding formal business or financial practices that a full-time business owner might do (such as opening a business banking account). This was often due to hidden fees, complex setup processes, and lack of clarity.

Missed banking opportunity → While many side ventures begin informally, a number eventually grow into full-fledged businesses. Banks are missing the chance to engage these customers early, by offering solutions that support them at the start of their journey and retain them by building loyalty as they scale.

Synthesising Insights

After our comprehensive user research process, we regrouped to synthesise insights and define our focus. We looked at recurring patterns from interviews, surveys, and secondary research, then discussed which opportunities were most impactful and aligned with the bank’s goals.

We then brainstormed and experimented with different ways of framing the problem, using tools such as How Might We (HMW) statements and user need statements. These exercises helped us translate our insights into actionable design opportunities and test different directions the project could take. We also experimented with our user persona.

HMW statement drafts

User persona drafts

From this process, we finally decided to focus on side business owners who are concurrently working full-time jobs, a group that often faces unique financial challenges and is currently underserved by existing banking solutions. This choice was guided both by our well substantiated research findings, and by the opportunity for the bank to capture value earlier in these customers’ journeys.

Eventually, we converged on a final HMW statement, which became the guiding frame for the rest of our ideation and design process:

“How might we help people with side businesses gain clarity and insights while navigating fragmented income streams?”

User Research

At the start of the programme, we were introduced to the problem statement and asked to interpret and hypothesise what it meant to us. To ground our understanding, we began with an in-depth interview with a customer who had already experienced a multi-stage career and non-linear life path. This allowed us to deep dive into their lived experiences, mapping the ups and downs across their different life stages and identifying how financial needs and decisions tied into those moments.

We also developed our user persona, to represent the typical side business owner: someone balancing a full-time job with an unregistered business, aspiring to scale it into a full-time venture, while struggling with financial management, business clarity, and recurring challenges that slows their growth.

Ideation & Prototyping

With our research process completed, we moved into the ideation phase, using design thinking methods to rapidly generate and explore potential solutions. This stage encouraged us to think broadly and creatively, even considering unconventional ideas, before narrowing down to those most feasible and impactful.

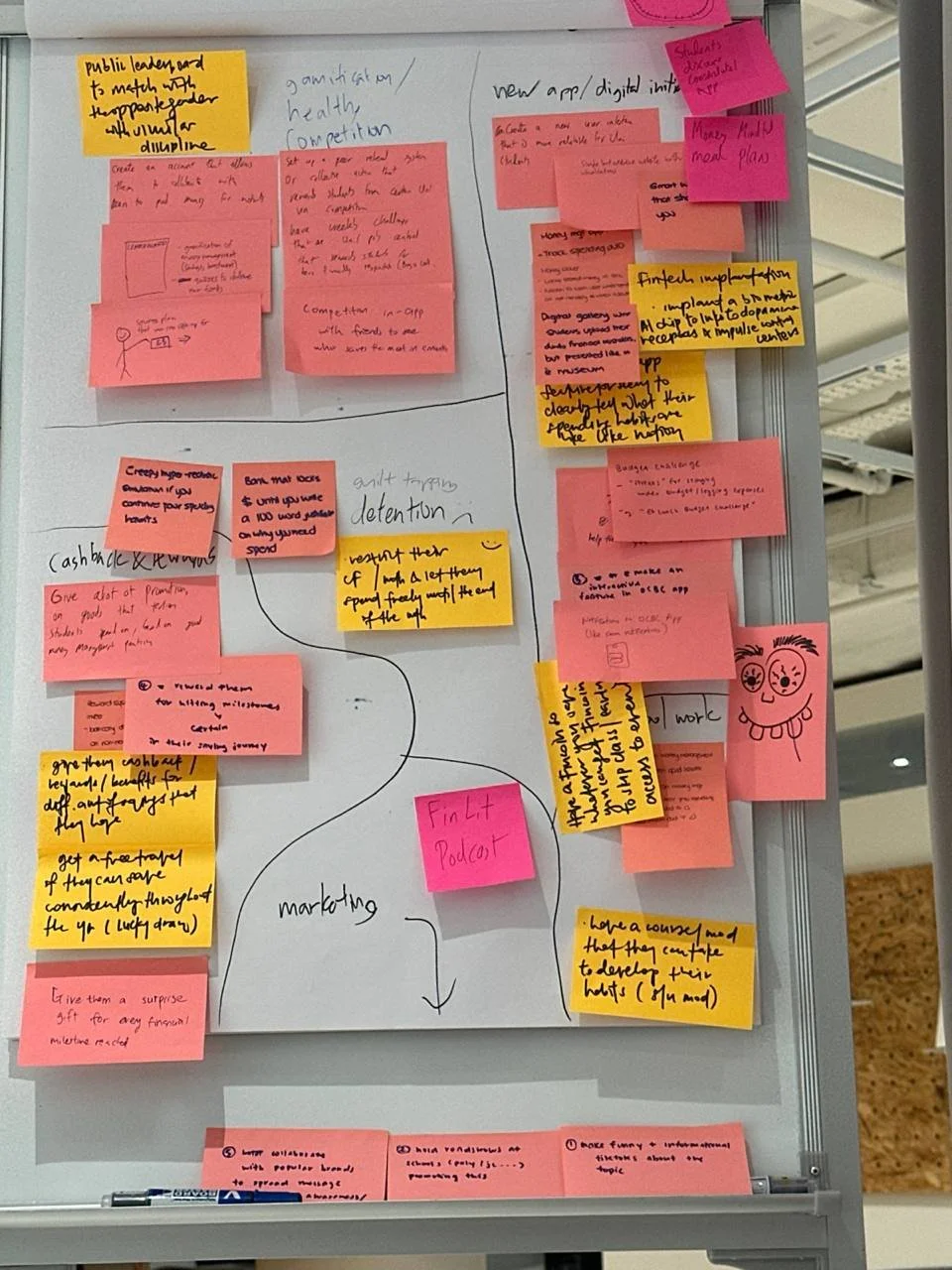

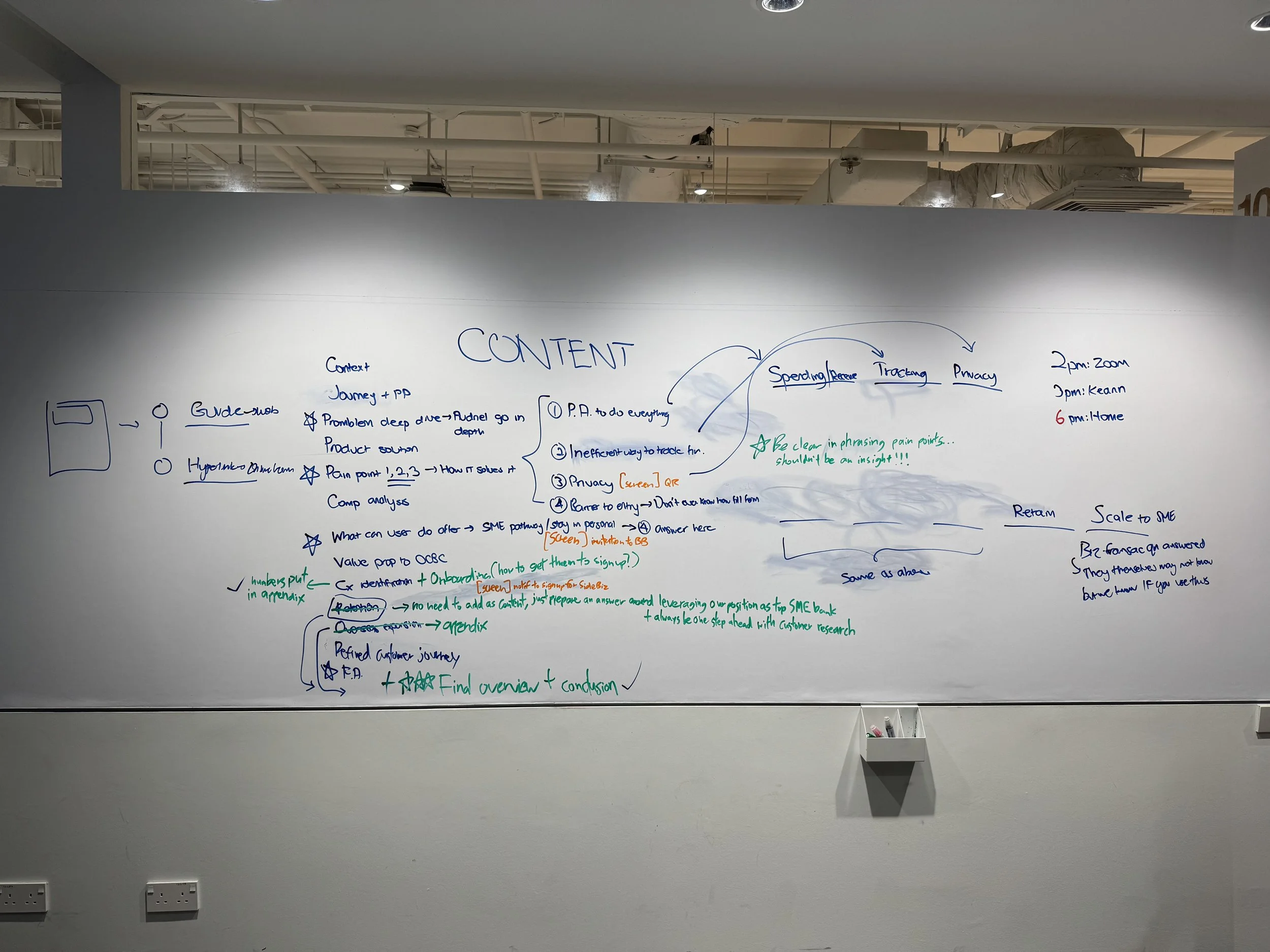

Brainstorming session

We eventually converged on a solution concept: an extra feature / widget embedded directly within the OCBC mobile banking app. This was driven by the aim of addressing the main problems and pain points surfaced from our user research. We wanted to design a convenient and accessible solution that directly tackled the following problems:

Problem 1

Many side business owners currently manage their ventures entirely through their personal accounts, mixing personal and business income and expenses. This creates a lack of clarity on how their business is performing and forces them to manually separate records, which is often inaccurate as well.

Hypothesised Solution 1

Embed business management tools directly within the personal account. By creating a clear separation or compartmentalisation of personal transaction vs business transaction inside their existing account, users can categorise and track business transactions without the need to open a separate business account (a process they often find inconvenient and complex).

Problem 2

Side business owners lack a centralised platform to track and manage their finances. Many still rely on fragmented tools such as phone notes, physical notebooks, or scattered Excel files, none of which provide a comprehensive overview.

Hypothesised Solution 2

Provide a central dashboard within the app that consolidates all key financial information relevant to a side business. This gives users a single place to monitor performance, identify trends (such as profitability), and manage their operations more effectively.

Insights on the pain points and problems faced by side businesses, as compiled from our surveys and interviews

We began to draw up low-fidelity wireframes to explore what this feature could look like within the OCBC mobile banking app. We also conducted several usability and concept testing sessions to gauge whether the designs were intuitive, easy to navigate, and aligned with users’ mental models. These sessions allowed us to gather early feedback on both the functionality and overall usefulness of our proposed solution.

Initial low-fidelity wireframes of mobile banking app feature

Based on the initial feedback, we refined the flow, simplified interactions, and prioritised the features that mattered most to the users, leading to the design of our first working prototype for OCBC SideBiz.

Entry points to OCBC SideBiz within the mobile banking app

First time setup screen, empty SideBiz homepage (when no transactions have yet been classified as business transactions), and classify transactions page which allows users to select transactions (both income and expenditure) which are part of their business ventures

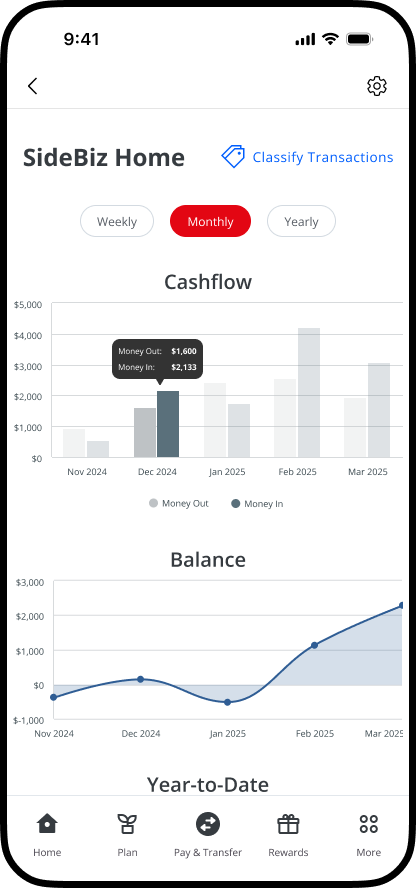

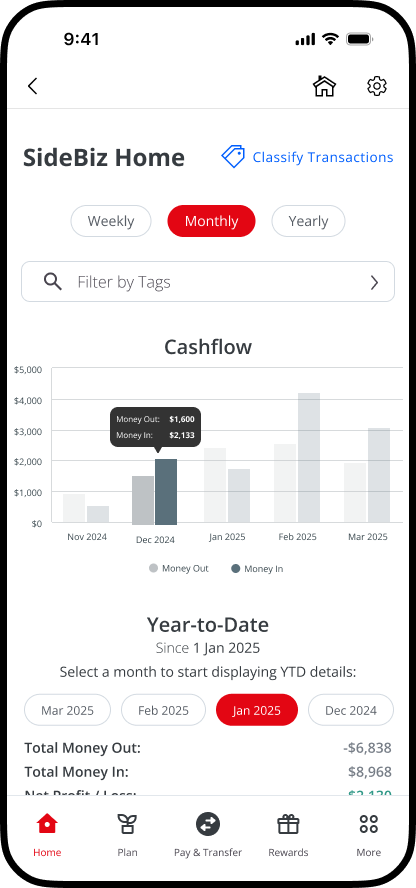

SideBiz homepage (upon completion of classify transactions page), 2nd screen shows long press function of cash flow chart, which opens detailed information

Usability & Concept Testing

From here on, our focus shifted to usability and concept testing: constantly iterating on the prototype to refine the solution, ensuring it addressed user needs, and bridging the gap between our conceptual model (how we expected users to interact with the product) and their mental model (how they naturally approached it).

We conducted both online and in-person testing sessions, where participants interacted with our high-fidelity working prototype. We asked them to perform realistic tasks that mirrored typical financial management scenarios for side business owners, while also giving them the freedom to approach the prototype from their own perspective. Participants could explore the features based on what they personally felt inclined to do. This combination of structured and open-ended testing allowed us to observe not only whether the product supported core use cases, but also how users would naturally adapt it to their individual needs.

Beyond validating our design, participants also raised suggestions for additional features they felt would be useful. These inputs gave us a clearer sense of their broader needs, highlighted pain points we had not initially considered, and helped us prioritise enhancements that would increase the solution’s long-term value.

Through this process, we discovered mismatches between our assumptions and user behaviour: certain features we thought would be useful were overlooked, while other seemingly minor details became crucial to users. These findings allowed us to adjust functionality and add new features that better reflected actual user needs.

Lastly, we refined the visual and interaction design: adjusting spacing, alignment, and typography to improve readability, hierarchy, and overall usability. We also made several quality-of-life improvements to interactive elements such as buttons or labels, which users had previously fumbled with during testing. These refinements, though subtle, contributed significantly to creating a more polished and cohesive user experience.

Online user testing conducted over Zoom

Here are some of the key things we learnt from user testing, and how we improved our product based on the feedback:

Balance graph

Users found the balance chart confusing and not very useful → we simplified the visualisation and focused on more meaningful insights.Splitting transactions

Users highlighted that some purchases cover both personal and business expenses (e.g. buying groceries and business supplies in one transaction) → we added a split transaction feature to separate them easily.Custom tags and categories

Users wanted the ability to organise transactions in ways that matched their business needs (e.g. tagging by sales event or product type) → we introduced custom tagging and creation of categories, and allowed insights on the dashboard to be filtered by these categories.Flexible date ranges

Some side business owners track finances on different year-to-date (YTD) cycles → we added a custom date range filter so they can view insights according to their own financial year.Excel export

A number of users still preferred Excel for deeper analysis and data manipulation → we added an easy export-to-Excel feature for those who want more control over their data and numbers.

Compiled user feedback

Final Solution

This set the stage for our final iteration of the solution, which we presented to senior leadership during the final showcase. By incorporating the ideal adjustments uncovered through user testing, we delivered a product that was both polished and comprehensive.

Crafted interview questions

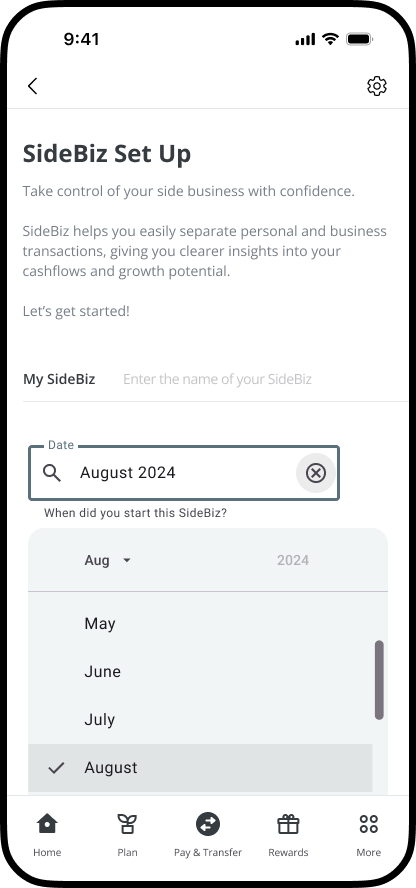

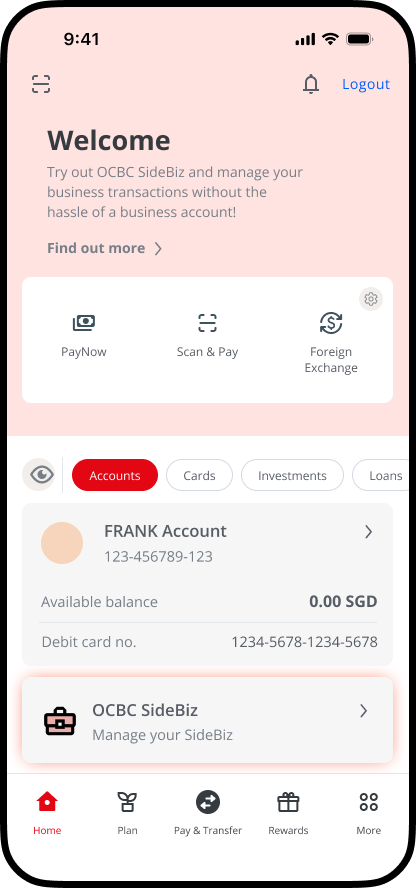

Entry points to OCBC SideBiz within the mobile banking app: “Find out more” message, “OCBC SideBiz” banner, and “SideBiz” icon within your personal account

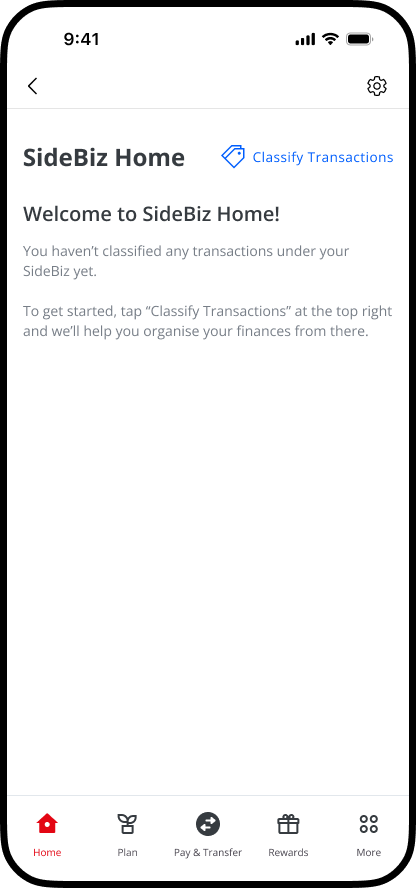

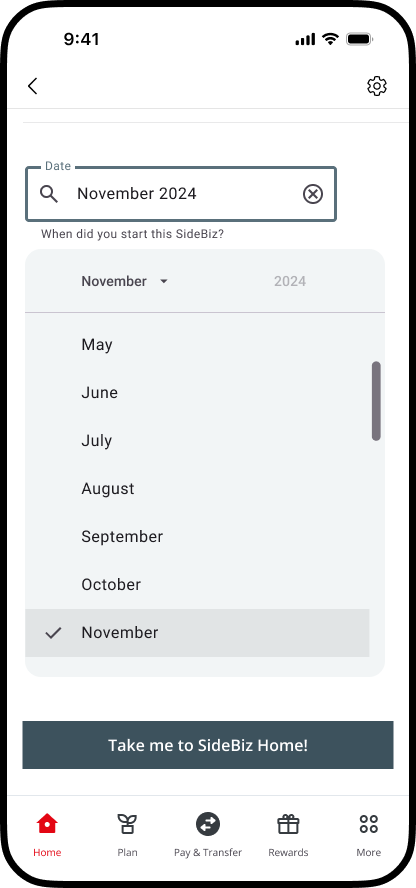

When clicking in to SideBiz for the first time, you are met with a one-time only set up screen

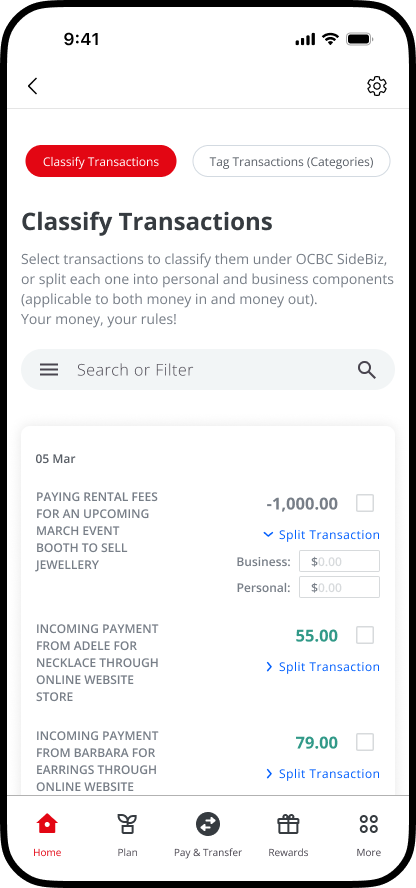

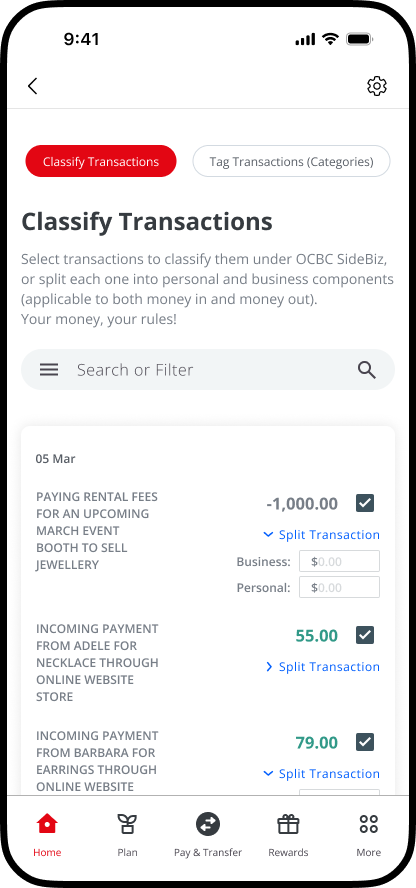

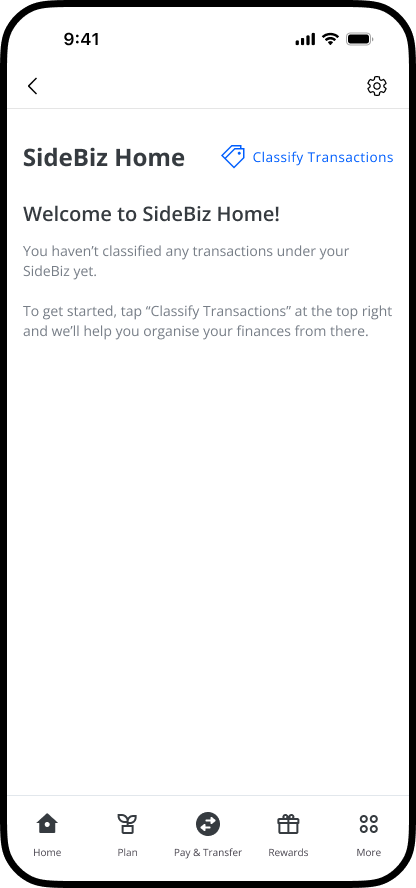

"Take me to SideBiz Home” button brings you to an empty homepage. To populate the page, you need to classify your SideBiz transactions by clicking the blue “Classify Transactions” button at the top right hand corner

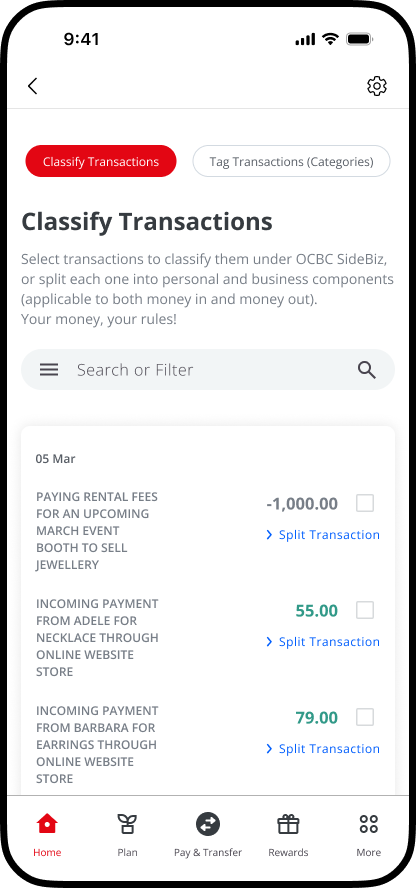

In the Classify Transactions page, tick the checkbox for all transactions belonging to your SideBiz. Press “Split Transaction” for those which require further differentiation within the same transaction

You can also click on the “Tag Transactions (Categories)” button to create custom tags and add them to various transactions. This is so that you can filter by these tags in the SideBiz homepage dashboard

Customer identification process through a combination of indicators, and how we might prompt users to register for OCBC SideBiz when they use the mobile banking app

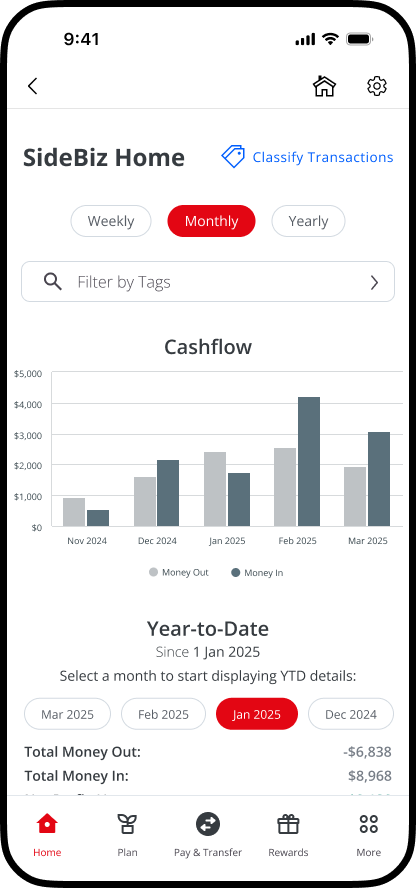

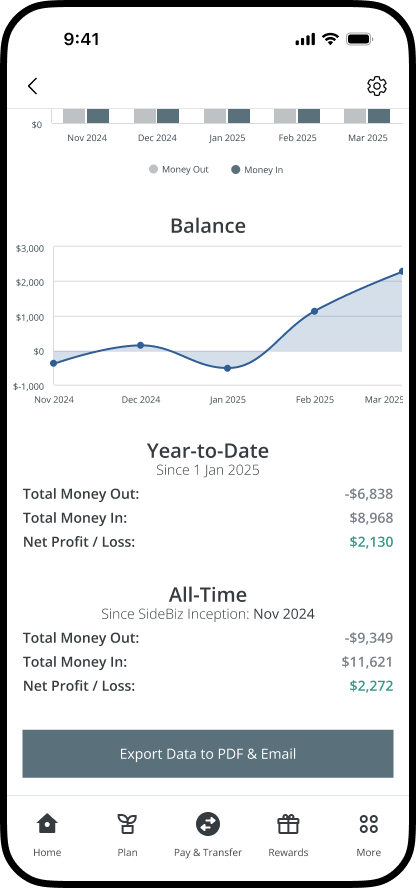

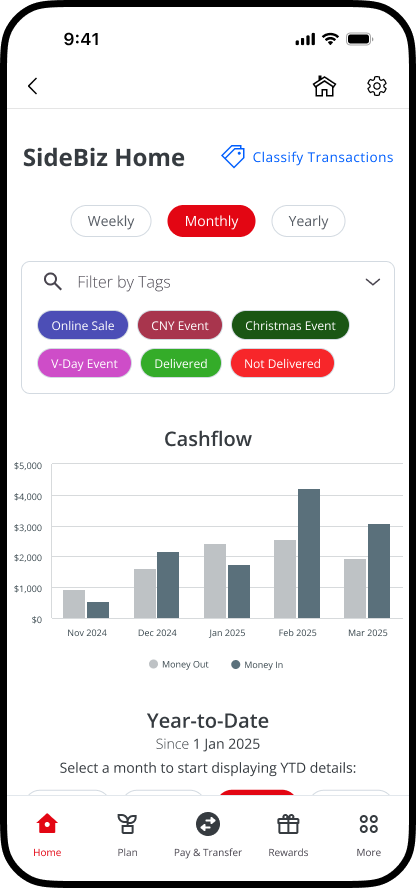

Upon completion of Classify Transactions and Tag Transactions, SideBiz homepage is now a populated dashboard. Users can filter the Cashflow graph by timeframe, and filter the YTD information by different start month. There is also a press & hold function in the Cashflow graph, so that users can open more detailed information about money in / money out

“Export Data to Excel Format” yields the following Excel sheet, for users to dabble in deeper levels of data manipulation or analysis

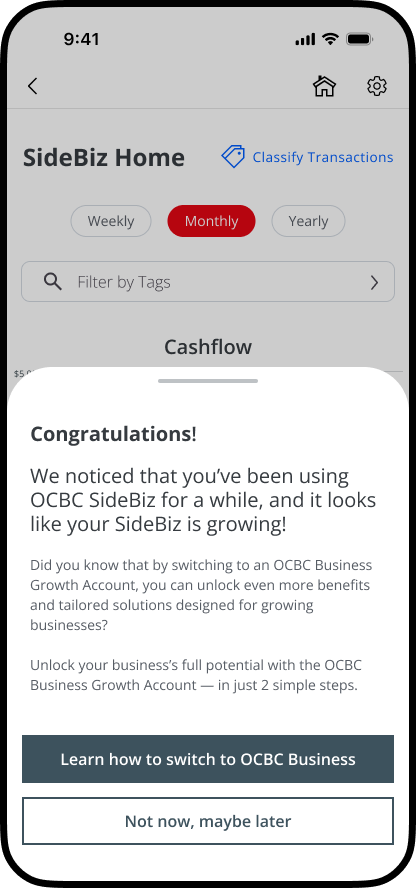

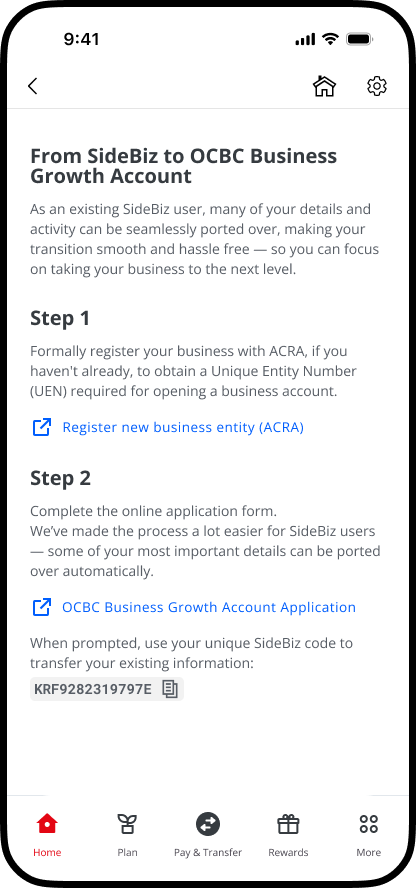

SideBiz will use criteria-based prompts to identify users showing positive growth trends that suggest their side business has the potential to scale into a formally registered venture. For these customers, existing account data can be leveraged to fast-track and simplify their upgrade to an OCBC business account

For users who choose not to scale into fully registered businesses, SideBiz will continue to engage them with tailored investment prompts. These offers are personalised around their SideBiz profits and positioned as opportunities to multiply their earnings, keeping them engaged

Lastly, users can filter their dashboard insights by the custom tags they created earlier in the Classify Transactions page, allowing them to view the dashboard by specific categories. These category views can then again be further distilled by timeframe (week/month/year)

Driving Stickiness & Value to the Bank

Lastly, part of our research also explored how the bank could attract side business owners and build long-term stickiness, ensuring that customers not only adopt SideBiz, but also choose to stay with the bank as their ventures grow. These mechanisms not only strengthen customer relationships, but also create a strong value proposition for the bank, driving revenue and retention.

This is what we learnt and how we designed for it:

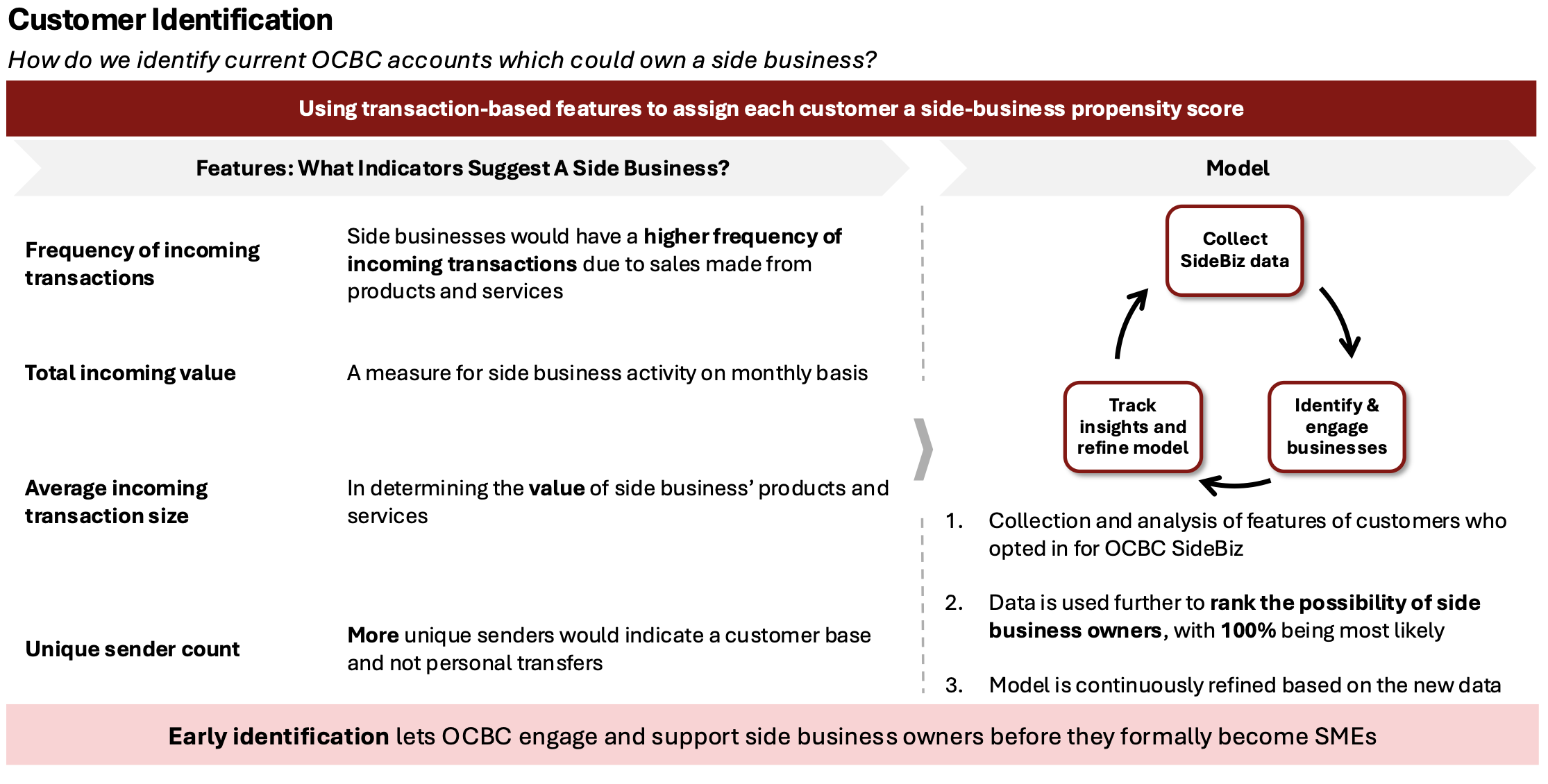

Customer identification, identifying potential side business behaviour → Users running side businesses from personal accounts often show unique transaction patterns (e.g. higher frequency of bulk incoming payments, consistent average transaction sizes, and a large number of unique senders). By detecting these signals, the bank can proactively prompt users to try SideBiz and highlight how it benefits them.

Supporting growth and scaling → Users whose side businesses show steady profit growth and positive trends can be identified through SideBiz usage. These customers can then be nudged to transition into a formal business account. To reduce friction, the bank can leverage existing customer data from SideBiz to fast-track the signup process, making it simple and convenient to scale within the same bank.

Unlocking value beyond scaling → Even users who don’t intend to register their business can still provide value to the bank. SideBiz can offer them targeted investment opportunities, using behavioural nudges (e.g. “Multiply your SideBiz income by investing in…”) to position relevant financial products. By making these offers feel personal and rewarding, the bank can deepen engagement and loyalty.

Final Thoughts

Our project and final presentation were well received by both the panel of senior bank leaders and the wider audience, which included mentors, supervisors, colleagues, and other staff from the bank. We were commended for proposing a solution that was not only practical, but also easy to envision as part of the bank’s roadmap in the near future. The prototype was also praised for being coherent with the bank’s existing app design language, making it feel seamless and realistic as a potential implementation.

Through this project, I gained hands-on experience with core UX methodologies and principles, which shaped every stage of our end-to-end design process. I particularly enjoyed engaging directly with customers through user research, concept testing, and usability sessions - these moments revealed to me the value and joy of designing with real users in mind, especially for underserved audiences.

This project was my first real foray into UX work, and it connected deeply with something I’ve always been passionate about: work that brings real meaning and positive impact to people’s lives. UX design, at its core, is about exactly that - understanding people’s needs and creating solutions that genuinely improves their quality of life. This alignment has inspired me to continue pursuing opportunities where I can create genuine impact through UX, and I’m excited to see where this journey takes me next.